Discover the Pros and Cons of Investing in Gold vs. Silver To Determine Which Is Best for You

As of early 2025, gold was trading at approximately $3,097 per ounce, nearly 90 times more expensive than silver, which hovered around $34 per ounce.

This striking price gap underscores one of the most fundamental differences between silver and gold coins and why the debate over silver vs. gold coins continues to captivate investors, collectors, and those seeking to preserve wealth.

Whether you’re a seasoned numismatist or a first-time precious metals buyer, understanding the differences between gold vs. silver is crucial.

Each metal has advantages, risks, and practical considerations. From affordability and market volatility to industrial demand and long-term performance, choosing the right metal can significantly impact your financial strategy.

In this article, we’ll break down the key factors that distinguish gold and silver coins, helping you determine which aligns better with your investment goals.

You’ll learn about:

- Affordability and accessibility: Comparing the cost of gold and silver coins and what that means for new and seasoned investors.

- Volatility and risk: How each metal reacts to market shifts and what that means for your portfolio.

- Industrial demand and economic sensitivity: How real-world uses impact pricing and investment potential.

- Storage and liquidity: Physical and logistical considerations of owning gold vs. silver coins.

- Historical performance: Insights into past performance and what that means for future returns.

Price and Value Differences

When comparing silver vs. gold coins, the most noticeable difference is price. As of mid 2025, gold is priced slightly over $3,400 per ounce, while silver trades at just shy of $38 per ounce. This nearly 90:1 price ratio highlights gold’s premium status and silver’s relative accessibility.

Gold Is Significantly More Expensive Per Ounce

Gold commands a much higher market price due to its rarity, demand from investors and central banks, and its role as a global monetary reserve.

Scarcity is a major factor. Gold is about 20 times rarer in the Earth’s crust than silver, and annual gold mining output is significantly lower by volume. This scarcity, combined with its historic role as money, drives its high per-ounce value.

- Gold: ~$3,400/oz (2025).

- Silver: ~$38/oz (2025).

- Gold is ~90 times more expensive than silver.

Silver Is More Accessible for New Investors

Silver’s lower entry point makes it an attractive option for beginner investors. Unlike with gold (unless you opt for fractional coins or bars, which often carry higher premiums), you can start investing in physical silver with just a few dollars.

- Lower cost allows for dollar-cost averaging.

- Easier to accumulate over time.

- Ideal for retail investors and collectors on a budget.

The Gold/Silver Ratio as a Valuation Tool

The gold/silver ratio measures how many ounces of silver it takes to purchase one ounce of gold. Historically, this ratio has averaged around 50–60, but in recent years it has often exceeded 80 and currently sits close to 90.

A high ratio may suggest that silver is undervalued relative to gold, potentially signaling a buying opportunity. Conversely, a low ratio could indicate gold is undervalued. Many seasoned investors use this ratio to strategically shift between the two metals.

Volatility and Risk Profiles

Gold Is More Stable During Uncertainty

Gold is widely considered a “safe haven” asset, retaining or increasing its value during economic downturns, geopolitical tensions, and currency devaluation. This stability makes gold coins a strong option for those seeking to preserve wealth and reduce overall portfolio risk.

- Lower daily price swings.

- More stable during recessions and crises.

- Favored by conservative investors and institutions.

Silver’s Price Swings Can Mean Higher Gains or Losses

Silver’s dual role as an investment asset and industrial commodity makes it more volatile but also offers greater upside potential during bull markets.

- Price moves often 2–3 times more than gold on a percentage basis.

- Tied more closely to economic cycles.

- Can outperform gold during strong economic growth.

Risk Tolerance and Investment Goals

I personally often advise a balanced approach, factoring in your financial objectives, time horizon, and comfort with market fluctuations. However,

- If you prioritize capital preservation and lower risk, gold may be the better fit.

- If you’re seeking potential upside and are comfortable with price swings, silver could provide more growth.

Industrial Demand and Economic Sensitivity

Silver’s Demand Is Tied to Tech and Green Energy

More than half of silver’s demand comes from industrial uses, making it highly sensitive to economic activity and manufacturing trends. Silver is widely used in:

- Electronics and semiconductors.

- Solar panels and renewable energy.

- Electric vehicles and batteries.

- Medical applications.

Gold Is Driven by Jewelry and Central Bank Reserves

Because gold is less tied to industrial cycles, it is more resilient during downturns. Central banks often increase holdings during uncertainty, supporting its price. Gold is closely tied to:

- Jewelry.

- Central bank reserves.

- Investment.

Economic Trends Impact Silver More Than Gold

- Silver reacts more to GDP growth and manufacturing output.

- Gold responds more to interest rates, inflation, and monetary policy.

Storage, Liquidity, and Practical Use

Gold Is Denser and Easier To Store Securely

- One ounce of gold is worth over $3,000.

- Requires less space and lower storage costs.

- Easier to transport discreetly.

Silver Is Bulkier and Costlier To Store

- Takes up more space per dollar invested.

- Higher storage costs over time.

- More difficult to transport in large amounts.

Silver Coins Offer Practical Advantages in Crises

- Easier for small transactions.

- More divisible for trade.

- Seen as “survival money.”

Historical Returns and Market Performance

Gold Has Outperformed Silver Over the Past Century

- Gold: ~4.81% annual return (1925–2023)

- Silver: ~3.71% annual return (1925–2023)

Both Metals Act as Safe-Haven Assets

- Inflation

- Currency devaluation

- Geopolitical instability

- Stock market crashes

Inflation-Adjusted Returns

- Gold: ~1.85% annually

- Silver: ~0.75% annually

Investment Strategy and Portfolio Role

Gold Is Favored for Wealth Preservation

- Long-term capital preservation

- Held by central banks

- Low correlation with equities

Silver Offers Growth Potential With Higher Risk

- Higher risk and reward

- Sensitive to industrial trends

- Accessible to retail investors

Many Investors Hold Both

- Gold for stability

- Silver for potential gains

- Diversification reduces risk

Comparing Gold vs. Silver Coins

| Feature | Gold Coins | Silver Coins |

|---|---|---|

| Price per ounce | ~$3,400 | ~$38 |

| Volatility | Low | High |

| Industrial Demand | Minimal | Over 50% |

| Storage | Compact | Bulkier |

| Liquidity | Very high | High |

| Historical Returns | ~4.81% | ~3.71% |

| Inflation Protection | Strong | Moderate |

| Spendability | Less practical | More practical |

| Risk Profile | Conservative | Aggressive |

| Recycling | Nearly all recycled | Harder to recycle |

Final Thoughts: Choosing Between Silver and Gold Coins

When weighing the pros and cons of silver vs. gold coins, remember that each metal serves a distinct purpose.

Gold offers a time-tested hedge against inflation, compact storage, and long-term stability. Silver provides a more affordable entry point, industrial demand exposure, and greater percentage gain potential but with higher volatility.

The decision depends on your goals, risk tolerance, and storage needs. Many investors diversify by holding both metals, using gold’s stability and silver’s growth potential to balance portfolios.

Before deciding, consult with professionals who understand the precious metals market. At Coinnotes News, our experts guide investors through every step.

Learn About the Current Trend in the Gold Market and Its Impacts

Gold has surged to historic heights in 2025, with prices climbing over 25% year to date and recently peaking near $3,500 per ounce. As of mid year, gold continues to trade in a strong range between $3,300 and $3,400, outpacing equities, bonds, and even other commodities.

With over 40 record highs already this year, the precious metal is proving once again why it’s considered the ultimate safe haven asset. According to forecasts from Goldman Sachs, J.P. Morgan, and others, this may just be the beginning of a longer term upward cycle.

Understanding the trends in the gold market is more crucial than ever. Whether you’re a seasoned bullion investor, a coin collector, or a financial strategist, the current environment presents both opportunities and risks that require informed analysis.

At Coinnotes News, our team of market analysts and numismatic researchers is tracking the forces shaping the gold landscape now and in the years ahead, a subject I personally find particularly interesting.

In this article, we’ll break down the key gold market trends today and what they may signal for the future. Here’s what you can expect to learn:

- Current gold price trends and institutional forecasts for 2025 and beyond.

- Major drivers behind gold’s price movements, including central bank activity and macroeconomic uncertainty.

- Structural shifts influencing long-term demand and the emergence of a new baseline price regime.

- Risks and volatility factors that could impact gold’s trajectory, from interest rate surprises to geopolitical resolutions.

- Investment insights for collectors and portfolio managers navigating this evolving market.

By the end of this post, you’ll have a comprehensive understanding of where the gold market stands in 2025 and what the road ahead could look like based on expert analysis and real world trends.

Current Gold Price Trends in 2025

Record High Prices and Year to Date Gains

Gold prices have entered a new stratosphere in 2025. With year-to-date gains exceeding 25%, gold reached a peak near $3,500 per ounce earlier this year. It currently trades within a robust range of $3,300 to $3,400 per ounce.

These figures represent not only nominal record highs but also a significant revaluation of gold’s role in the global financial system.

This performance stands out in a year when many traditional assets have struggled. The S&P 500 has seen only modest gains, and bond markets remain under pressure due to inflation concerns and uncertain monetary policy.

Gold, by contrast, has delivered a consistent upward trend, setting more than 40 new all-time highs by mid year.

Institutional Forecasts and Market Outlook

Major financial institutions are forecasting continued strength in the gold market, with several bullish predictions extending into 2026 and beyond:

- Goldman Sachs projects gold will reach around $3,700/oz by the end of 2025, with potential spikes to $3,880/oz if recessionary pressures deepen.

- J.P. Morgan anticipates an average price near $3,675/oz in Q4 2025 and as high as $4,000/oz by mid 2026, citing geopolitical risks and central bank demand.

- State Street Global Advisors sees a sustained trading range between $3,000–$3,500/oz, with bullish scenarios pushing prices to $4,000/oz.

- InvestingHaven and other independent analysts suggest gold could rise to $3,900/oz in the medium term and potentially hit $5,000/oz by 2030.

These forecasts reflect a consensus that the gold market is undergoing a structural shift, not just a speculative rally.

Market Performance vs. Other Assets

Gold’s performance in 2025 has far outpaced most other major asset classes. While equities, real estate, and bonds have experienced mixed results, gold has emerged as a clear outperformer.

This reinforces its traditional role as a hedge against uncertainty and inflation. Investors seeking capital preservation and portfolio diversification are increasingly turning to gold, both in physical and financial forms.

Drivers of Gold Price Movements

Central Bank Accumulation

One of the most significant drivers of gold demand in 2025 is central bank buying. Nations like China and Poland have been purchasing gold at record levels.

In Q1 2025 alone, global central banks added 244 tonnes (metric tons) of gold to their reserves, well above the five year quarterly average. This trend reflects a strategic move to diversify foreign exchange reserves and reduce reliance on the US dollar.

- China’s People’s Bank of China (PBoC) has increased gold reserves for 18 consecutive months.

- Poland’s central bank has surpassed its 2024 gold acquisition targets ahead of schedule.

Investment Demand and ETF Flows

In addition to sovereign buyers, private and institutional investment demand is surging. Gold backed ETFs saw inflows of over $21.1 billion in Q1 2025, pushing global holdings to 3,445 tonnes.

These inflows tighten the physical supply and validate gold’s safe haven appeal in a volatile macro environment.

As Coinnotes News analysts often explain, ETF demand acts as a real-time indicator of market sentiment. When these funds swell, it signals that investors are seeking protection from systemic risks.

Macroeconomic Uncertainty and Safe Haven Demand

2025 has been marked by persistent economic uncertainty. The global economy faces:

- Stagflation risks, a toxic combination of high inflation and slowing growth.

- Geopolitical instability, including unresolved conflicts and trade tensions.

- Recession concerns, especially in Europe and parts of Asia.

In such an environment, gold’s reputation as a store of value and crisis hedge becomes even more attractive. Investors are reallocating capital from riskier assets to gold, reinforcing upward price momentum.

Dollar Weakness and Interest Rate Trends

Another key factor supporting gold prices is the weakening of the US dollar. As the dollar declines, gold becomes cheaper for foreign buyers, increasing global demand.

Additionally, with US interest rates expected to decline from their current range of 4.25% to 4.50%, the opportunity cost of holding non-yielding assets like gold decreases. This makes gold more competitive relative to bonds and savings instruments.

Structural Shifts in the Gold Market

Higher Baseline Price Regime

Perhaps the most important development in 2025 is the emergence of a new price regime. What was once considered a ceiling, $2,000 per ounce, is now viewed as a floor. Gold consistently trading above $3,000/oz suggests a structural revaluation of its role in the global economy.

This shift is driven by long-term trends, including:

- Persistent inflationary pressures.

- De-dollarization and global monetary diversification.

- Institutional adoption and portfolio integration.

Global Demand and Regional Dynamics

Demand for gold is also expanding geographically. Asia Pacific markets, particularly Japan, India, and Southeast Asia, are seeing increased investment in gold due to favorable tax policies, cultural preferences, and government initiatives promoting gold ownership.

In Japan, for instance, regulatory changes have made gold ETFs more accessible to retail investors, while in India, digital gold platforms are boosting younger demographic participation.

Inflation and Currency Pair Impacts

Gold’s inverse relationship with the US dollar remains a cornerstone of its pricing dynamics. However, other currency pairs, such as EUR/USD, are also exerting influence.

A stronger euro, for example, often correlates with higher gold prices as European investors find gold more affordable and attractive as an inflation hedge.

Risks and Volatility in the Gold Market

Short-Term Price Swings

Despite the bullish outlook, gold is not immune to volatility. Positive surprises in US economic data or unexpectedly hawkish Federal Reserve comments can trigger short-term pullbacks.

Such moves are typically driven by strengthening bond yields or temporary dollar rallies, which reduce gold’s relative attractiveness.

Downside Scenarios and Demand Reversals

Potential downside risks include:

- Resolution of major geopolitical conflicts, which may reduce safe haven demand.

- Faster than expected global recovery, which could shift capital back to risk assets.

- Reversal in central bank buying if monetary authorities reassess reserve strategies.

In such scenarios, gold could see corrections in the range of 12% to 17%, according to Coinnotes News analysts. However, these would likely be viewed as buying opportunities within a longer term bullish trend.

Extreme Events and Unlikely Outcomes

Some analysts have floated the theoretical possibility of gold reaching $10,000/oz in the event of hyperinflation or a collapse in global monetary confidence.

While not impossible, such outcomes would require extreme geopolitical or economic dislocation and remain highly improbable under current conditions.

Forecast Summary and Analyst Comparisons

| Institution / Analyst | 2025 Price Forecast Range (USD/oz) | Key Drivers / Comments |

|---|---|---|

| Goldman Sachs | $3,220–$3,880 | Central bank buying, ETF inflows, recession risk |

| State Street Global Advisors | $3,000–$4,000+ | Stagflation, de dollarization, sustained demand |

| J.P. Morgan | $3,500–$4,000 (2025–26) | Geopolitical risk, recession probabilities |

| InvestingHaven | $3,500–$3,900 (mid term), up to $5,000 | Inflation, long term bullish trend, central bank demand |

| World Gold Council | $3,300–$3,500+ | Weaker US dollar, geopolitical tensions |

Gold Investment Insights for 2025

Gold as a Portfolio Diversifier

Gold plays a vital role in reducing overall portfolio risk, especially during periods of economic turbulence. It has a low correlation with equities and fixed income, making it an effective hedge against inflation and market volatility.

Investment Vehicles and Access Points

Investors can gain exposure to gold through various channels:

- Physical Gold: Coins and bars offer tangible ownership but come with storage and insurance considerations.

- ETFs: Provide liquidity and ease of trading but may incur management fees.

- Futures Contracts: Suitable for sophisticated investors seeking leverage but riskier due to price volatility.

- Gold Trusts: Offer a hybrid approach with secure backing and ease of access.

Supply Constraints and Market Implications

With demand rising and new mine production relatively flat, the gold market is tightening. This imbalance may lead to higher premiums for physical gold and reduced liquidity in certain market segments.

Recycling and scrap supply may partially offset the gap but not enough to meet surging global interest.

Final Thoughts: Navigating the Gold Market in 2025 and Beyond

As we move through 2025, the gold market continues to reflect a powerful intersection of macroeconomic uncertainty, central bank strategy, and shifting investor behavior.

Record high prices and strong institutional forecasts suggest that gold may not only sustain its elevated levels but also climb higher in the coming years.

However, while the long term outlook remains bullish, short term volatility and potential downside risks, from geopolitical resolutions to stronger than expected economic recoveries, should not be overlooked.

For investors, portfolio managers, and collectors alike, understanding these gold market trends today is essential.

Whether you’re navigating ETF inflows, evaluating physical gold premiums, or tracking central bank behavior, staying informed can make all the difference in capitalizing on opportunities while managing risk effectively.

At Coinnotes News, our team of analysts continues to monitor the evolving landscape to provide data-driven insights and actionable strategies tailored to the needs of gold-focused investors.

Stay strategic, stay informed, and let Coinnotes News be your trusted source in navigating the dynamic world of precious metals.

Expert Tips on Valuing, Grading, and Selling Your Gold Coins for Maximum Profit and Security

Over the past five years, the price of gold has surged more than 50%, reaching some of its highest levels in history.

For collectors and investors holding rare gold coins or valuable gold coins, this market upswing represents a prime opportunity to turn those assets into cash, but doing it right requires more than just walking into the nearest coin shop.

If you’re wondering how to sell gold coins for cash, understanding the process from valuation to transaction is key to maximizing your return and avoiding costly mistakes. The team at Coinnotes News has put together this comprehensive guide to help you navigate every step with confidence.

Here’s what you’ll learn in this article:

- What makes gold coins valuable beyond their gold content, including numismatic factors.

- How coin grading and authentication can significantly impact your sale price.

- The pros and cons of different selling methods, from local dealers to online platforms.

- A step-by-step breakdown of how to prepare, price, and complete a sale.

- Common mistakes sellers make and how to avoid them.

By the end of this guide, you’ll know exactly how to sell gold coins, whether you have bullion or collectible coins, for the best possible price while protecting your assets and avoiding unnecessary risks. Let’s get started.

Understanding What Makes Gold Coins Valuable

Before you can sell your gold coins, it’s essential to understand what gives them value. While the gold content itself plays a major role, many coins also carry numismatic value, which is a premium based on rarity, demand, and historical significance.

For me, learning about numismatic value was a huge learning curve, but trust me; the more you understand about your coins’ true worth, the more prepared you’ll be when you’re ready to sell.

Gold Content and Market Price

Most gold coins are valued in part based on their bullion content. This is measured in troy ounces, with common purities including 22 karat (91.67% pure) and 24 karat (99.99% pure).

The current market price of gold, known as the spot price, is set by global benchmarks like the London Bullion Market Association (LBMA).

- Check live gold prices on trusted financial platforms or bullion dealers.

- Multiply the coin’s gold weight by the current spot price to estimate its melt value.

However, bullion value is just the starting point. Many coins are worth much more due to collectibility.

Rarity and Numismatic Value

Rare gold coins and valuable gold coins often command prices well above their metal content. According to this article from Coinfully about how to sell gold coins, this numismatic value is influenced by factors such as:

- Mint year and location: Older coins or those from limited mints can be prized by collectors.

- Condition: Coins in pristine condition (especially uncirculated) are more desirable.

- Historical significance: Coins tied to key events or eras may fetch a premium.

For example, a common American Eagle may sell near its bullion value, while a rare 1933 Double Eagle could be worth millions due to scarcity and history.

Coin Type and Popular Examples

Some gold coins are more recognizable and in higher demand, which can boost resale value. Popular gold coins include:

- American Gold Eagles: Backed by the U.S. Mint, highly liquid and trusted worldwide.

- Krugerrands: South African coins known for their durability and wide recognition.

- British Sovereigns: Historic coins with strong collector interest.

The more widely recognized your coin is, the easier it will be to sell and the more offers you’re likely to receive.

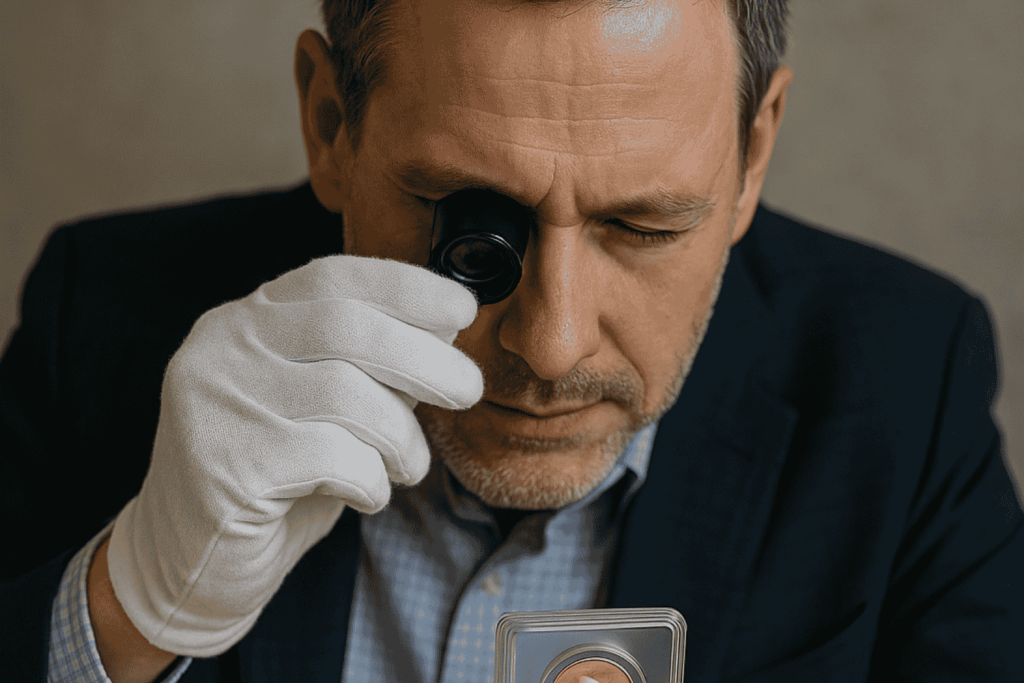

Coin Grading and Authentication

Grading and authenticating your gold coins is one of the most important steps to getting top dollar. A professionally graded coin provides buyers with confidence in its quality and legitimacy.

Professional Grading Services

Trusted grading companies like the Numismatic Guaranty Company (NGC), Professional Coin Grading Service (PCGS), and Certified Acceptance Corporation Grading (CACG) evaluate coins using the Sheldon Scale, which ranges from 1 (poor) to 70 (perfect condition).

Once graded, coins are sealed in tamper-proof holders, often called “slabs,” that include certification details. This encapsulation protects the coin and adds legitimacy.

Benefits of Certification

Certified coins typically sell faster and for higher prices. Buyers are more willing to pay a premium for coins that have been professionally authenticated and graded. Certification can:

- Reduce buyer skepticism and risk.

- Provide a standardized condition rating.

- Protect coins from damage and tampering.

Preliminary Self-Grading

While professional grading is ideal, basic self-assessment can help you gauge value before submitting coins. Look for:

- Surface wear or scratches.

- Shine or luster.

- Sharpness of design details.

Use online comparison tools or coin catalogs to estimate grading, but remember that only certified grades carry weight in the market.

Preparing To Sell Your Gold Coins

The way you prepare your coins can directly impact how much you earn from a sale. Follow these key steps before listing or approaching a buyer.

Document and Organize

Gather all available documentation, including:

- Receipts or proof of purchase.

- Grading reports and certificates.

- Notes on weight, purity, and type for uncertified coins.

Organizing this information helps you present your coins professionally and supports claims of authenticity.

Research Current Prices

Monitor the current gold spot price and trends in the collectible coin market. This helps you pick the right time to sell and set realistic expectations.

- Use resources like Kitco and the LBMA market updates.

- Compare recent sales of similar coins on auction sites or dealer listings.

Store and Handle Properly

Never clean your coins, since doing so can reduce their value dramatically by altering the surface. Instead:

- Use cotton gloves when handling.

- Store in acid-free holders or coin capsules.

- Keep in a dry, secure location.

Where and How To Sell Gold Coins

There are several ways to sell gold coins, each with its own pros and cons. Your choice may depend on your goals, such as speed, convenience, or maximizing profit.

Local Coin Dealers and Shops

These offer quick, face-to-face transactions and immediate cash. However, dealers need to make a profit, so offers may be below market value.

- Pros: Fast, secure, and simple

- Cons: Lower payouts, especially for rare gold coins

Online Buyers and Marketplaces

Platforms like Coinfully and Kitco offer free appraisals, insured shipping, and fast payments. Selling online gives you access to a broader audience.

- Pros: Competitive offers, convenience, reach

- Cons: Must verify buyer reputation, shipping risks

Auctions and Collector Forums

These are ideal for rare or valuable gold coins. Auctions may drive up prices through bidding wars, but they often take time and involve seller fees.

- Pros: Potential for high prices, targeted buyers

- Cons: Commission fees, longer sale process

Precious Metal Buyback Programs

Many mints and bullion dealers offer buyback programs, often paying near spot price for bullion coins.

- Pros: Transparent pricing, reliable

- Cons: Not ideal for coins with numismatic value

Step-by-Step Guide for Selling Valuable Gold Coins

Follow this proven process to sell your gold coins confidently and securely.

Step 1: Identify and Assess

Determine the coin’s type and gold content and whether it’s certified. Use catalogs or online tools if needed.

Step 2: Get Multiple Offers

Always get quotes from several sources. Use online quote forms or visit multiple dealers to compare.

Step 3: Authenticate and Inspect

Buyers may inspect your coin for authenticity. For uncertified coins, consider submitting to NGC or PCGS beforehand.

Step 4: Negotiate Fairly

Use your research to back up your asking price. Be firm but open to reasonable counteroffers.

Step 5: Finalize the Sale

Complete the transaction in writing. Get a receipt, and choose a secure payment method such as bank transfer or certified check.

Step 6: Ship Securely

If selling remotely, use insured, trackable shipping. Package coins carefully and retain proof of delivery.

Factors That Affect How Much You’ll Get

Condition and Grade

Higher graded coins command premium prices. Certified coins are especially attractive to collectors and investors.

Market Timing

Selling when gold prices are high can maximize returns. Monitor spot prices and economic trends regularly.

Rarity and Demand

Rare gold coins or those in high demand can sell for much more than their melt value. Historical coins or limited mintage items often fall into this category.

Dealer Reputation

Well-known, trusted dealers may offer slightly less but provide security and peace of mind. Private sales may yield more, but they carry more risk.

Tax and Legal Considerations

Profits from selling gold coins may be subject to capital gains tax, depending on your country or state. It’s important to:

- Keep detailed records of purchases and sales.

- Consult a tax professional if unsure about reporting requirements.

- Check local laws regarding documentation and ID requirements.

Safety and Fraud Prevention

Protecting yourself is just as important as maximizing profit. Follow these safety tips:

Verify Buyer Credentials

Only work with licensed dealers or platforms with strong reputations. Look for BBB ratings and professional affiliations.

Use Secure Methods

- Always use insured shipping when mailing coins.

- Get written receipts for all transactions.

- Use verified payment methods such as bank transfers or escrow services.

Avoid Common Scams

- Never accept unsolicited offers.

- Decline lowball offers from pawn shops without comparison.

- Always get multiple appraisals before agreeing to a sale.

Final Thoughts on Selling Gold Coins

Successfully selling gold coins requires more than just knowing their melt value. Whether you’re holding rare gold coins with historical significance or valuable gold coins with numismatic appeal, understanding grading, authentication, market trends, and buyer credibility is key to achieving the highest return.

As we’ve outlined, taking the time to organize your documentation, get multiple offers, and select the right selling method can significantly impact your payout.

Certified coins, in particular, tend to attract more competitive bids and faster sales. Remember that timing the market and working with reputable buyers can make all the difference.

If you’ve been wondering, How to sell my gold coins?, don’t rush the process. Instead, prepare strategically and educate yourself using trusted resources. The professionals at Coinnotes News are here to help you every step of the way.

Explore Coins Worth Hundreds of Thousands and Learn What Impacts Their Value

In 2021, a single gold coin, the 1933 Saint-Gaudens Double Eagle, sold at auction for a staggering $18.9 million. That’s not just a record; it’s a bold reminder that some gold coins are worth far more than their weight in gold.

For collectors, historians, and investors alike, the most valuable gold coins represent a unique blend of rarity, beauty, and historical intrigue.

So, what exactly makes a gold coin command such astronomical prices? Whether you’ve inherited a coin collection or are considering investing in numismatics, understanding what sets these coins apart is essential.

While all gold coins hold intrinsic value due to their precious metal content, a select few rise into the realm of legends, becoming prized artifacts of history and symbols of wealth preservation.

In this article, we’ll explore:

- What defines a coin as one of the most valuable gold coins.

- The top 10 examples, including their historical context and record-breaking sales.

- The key factors that influence a gold coin’s value, from rarity to provenance.

- Grading and authentication basics that every collector should know.

- How to start collecting or investing in gold coins worth money.

By the end of this guide, you’ll not only know which gold coins are worth the most but also why they matter and how to evaluate their worth like a seasoned numismatist.

Whether you’re a curious enthusiast or a serious investor, the professionals at Coinnotes News are here to help you learn about the rarest gold coins and how to identify treasures in your collection.

What Makes a Gold Coin Valuable?

When it comes to the most valuable gold coins, their worth goes far beyond the current price of gold. While gold content does set a foundational value, the highest-priced coins are prized for their rarity, historical importance, condition, and collector demand.

Let’s break down the key factors that determine why some gold coins are worth millions while others are valued only slightly above their melt weight.

Rarity

One of the most significant drivers of a coin’s value is its rarity. Some gold coins were minted in extremely limited numbers, while others have become rare over time due to melting, hoarding, or loss. The fewer examples that exist, the more desirable a coin becomes to collectors.

- Low original mintage numbers (e.g., under 100 coins struck)

- Surviving population (some coins have only 1–3 known examples today)

- Unique varieties or error coins (such as misstruck dies or date anomalies)

Coins like the 1849 Double Eagle and the 1822 Capped Bust Half Eagle are extraordinarily rare, with only a single or a few known examples, elevating their status, and price, to legendary levels.

Historical Significance

Coins that are tied to important events in history often carry added value. Whether it’s the California Gold Rush, the Great Depression, or the early days of the U.S. Mint, a coin’s backstory can dramatically increase its appeal.

- Tied to major economic or political events (e.g., the 1933 gold recall)

- First or last of their kind (e.g., the first $20 gold coin in 1849)

- Coins from transitional minting periods or experimental issues

These historical links capture the imagination of collectors and investors who see coins as tangible links to the past.

Condition and Grading

Condition is everything in numismatics. A coin in pristine condition can be worth exponentially more than one that’s worn or damaged. Coins are graded on the Sheldon Scale, which ranges from 1 (Poor) to 70 (Perfect Mint State).

- Mint State (MS 60–70): Never circulated, with full mint luster

- Proof (PR): Specially struck for collectors, often mirror-like in appearance

- Circulated: Graded lower based on wear, scratches, and surface issues

Professional grading services like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Company) assign these grades and provide authentication, which adds credibility and value to a coin.

Gold Content and Purity

Though not the primary driver of value for rare coins, gold content still matters. Most valuable gold coins are made from 22-karat (91.67% pure) or 24-karat (99.99% pure) gold.

- 1 oz coins are most common, but weights vary.

- Gold content sets a melt value, but collectible coins sell far above this baseline.

For example, a 1 oz gold coin might have a melt value of around $3,400 (depending on the current gold price), but a rare historical coin of the same weight could fetch hundreds of thousands or even millions of dollars.

Market Demand and Provenance

A coin’s value is also influenced by how much collectors are willing to pay, which is shaped by current trends, economic conditions, and the coin’s ownership history.

- Coins with famous past owners (e.g., kings, presidents, or museums)

- Coins involved in legal battles or long-lost discoveries

- Coins featured in major auctions or numismatic literature

Provenance adds a layer of storytelling that can make rare coins even more desirable. At Coinnotes News, we often advise collectors to consider both current demand and long-term market trends when evaluating coins.

The Top 10 Most Valuable Gold Coins

#1: 1933 Saint-Gaudens Double Eagle

Arguably the most famous U.S. gold coin, the 1933 Saint-Gaudens Double Eagle is a masterpiece of design and intrigue.

- Designer: Augustus Saint-Gaudens, one of America’s most celebrated sculptors.

- Design: Features Lady Liberty striding forward with a torch and olive branch and a majestic eagle in flight on the reverse.

Although over 445,000 were minted, none were officially released due to President Franklin D. Roosevelt’s 1933 gold recall. Most were melted down. Only 13 are known to survive, making it one of the rarest gold coins in existence. In 2021, one example sold for a record-breaking $18.9 million.

#2: 1849 Double Eagle

This coin marks the beginning of the $20 gold piece, born from the influx of gold during the California Gold Rush.

- Pattern Coin: Never intended for circulation, only two were struck.

- Current Location: One resides in the Smithsonian Institution; the second’s status is uncertain.

Because it was the prototype for all future Double Eagles and only one is confirmed to survive, experts estimate its value at around $20 million, making it possibly the most valuable U.S. gold coin of all time.

#3: 1907 Saint-Gaudens Double Eagle (High Relief)

Another creation of Augustus Saint-Gaudens, this coin was designed to elevate U.S. coinage to a new level of artistry.

- High Relief Design: Created with deep, sculptural detail that caused minting issues.

- Production Challenges: Required multiple strikes per coin, leading to a switch to lower relief.

Collectors prize this high-relief version for its beauty and limited production. Depending on condition, these coins can fetch up to $475,000 at auction.

#4: 1804 Eagle Gold Coin

This $10 gold piece is a standout from the early days of the U.S. Mint.

- Design Features: Classic Turban Head Liberty and heraldic eagle.

- Varieties: Identified by the number and arrangement of stars.

Depending on the variety and grade, the 1804 Eagle has sold for as much as $565,000, especially those with unique die characteristics.

#5: 1822 Capped Bust Half Eagle

With only three known examples, the 1822 Half Eagle is among the rarest of all U.S. gold coins.

- Auction Record: One sold in 2021 for over $8 million.

- Ownership: Two are in the Smithsonian, making private ownership nearly impossible.

Its extreme rarity and historical context make it a true numismatic treasure.

#6: Brasher Doubloon (1787)

Minted before the creation of the U.S. Mint, the Brasher Doubloon is a piece of American monetary history.

- Creator: Goldsmith Ephraim Brasher, a neighbor of George Washington.

- Privately Minted: The coin bears Brasher’s hallmark stamp “EB.”

Only a few exist, and they have sold for as much as $9.36 million. It’s a cornerstone of early American numismatics.

#7: 1854-S Half Eagle

Struck at the newly opened San Francisco Mint, this coin is tied directly to the California Gold Rush.

- Rarity: Only a few examples are known to exist.

- Estimated Value: Multi-million dollar range depending on condition.

This coin marks a pivotal moment in westward expansion and American minting history.

#8: 1870-S Three Dollar Gold Piece

An enigmatic coin with a mysterious backstory, the 1870-S $3 gold piece was not officially documented at the time of its minting.

- One Known Example: Discovered in a private collection.

- Estimated Value: Several million dollars.

Its existence raises questions among numismatists, adding to its allure as one of the rarest gold coins.

#9: 1930-S Indian Head Eagle

This $10 gold coin represents the end of an era in U.S. coinage.

- Design: Features Lady Liberty wearing a Native American headdress.

- Historical Context: Among the last gold coins minted before the 1933 recall.

With limited surviving examples in high grade, auction prices can exceed six figures, making it a sought-after piece for advanced collectors.

#10: Edward III Florin (1344)

Also known as the “Double Leopard,” this medieval English coin is one of the oldest and rarest gold coins ever discovered.

- Historical Significance: Issued during the reign of Edward III as an attempt to create a new gold currency.

- Auction Record: One sold for over $6.8 million.

Only three known examples exist, making it one of the rarest and most valuable coins in the world.

Understanding Coin Grading and Authentication

The Sheldon Scale (1–70)

Developed in the 1940s, this scale is now the industry standard:

- 1–59: Circulated coins with various levels of wear

- 60–70: Mint State (MS) coins with no circulation wear

- Proof Coins (PR/PF): Specially made for collectors, often graded separately

Professional Certification

Trusted third-party grading services include:

- PCGS (Professional Coin Grading Service)

- NGC (Numismatic Guaranty Company)

These organizations provide encapsulation (slabbing), grading, and authentication, all of which boost a coin’s credibility and market value.

Why Not To Clean Coins

Never clean a coin. Even well-intentioned cleaning can cause micro-scratches and reduce a coin’s grade. Always preserve coins in their natural state.

Collecting and Investing in Valuable Gold Coins

Start With Research

Learn about different coin types, historical periods, and market trends. Resources like auction records, coin catalogs, and professional articles are invaluable.

Consider Modern Bullion Alternatives

If million-dollar rarities are out of reach, consider:

- American Gold Eagles

- Canadian Maple Leafs

- Gold Krugerrands

These are widely traded, are easy to authenticate, and often feature designs inspired by historical coins.

Work With Reputable Dealers

Always:

- Compare dealer premiums.

- Review return and buyback policies.

- Verify grading and authenticity guarantees.

A trusted dealer ensures you’re paying a fair price and getting genuine coins.

Final Thoughts: Gold Coins That Transcend Time and Value

The most valuable gold coins are far more than just precious metal artifacts; they are historical treasures, investment vehicles, and timeless works of art.

From the legendary 1933 Saint-Gaudens Double Eagle to the enigmatic 1870-S Three Dollar Gold Piece, each coin carries a story that enhances its rarity and value.

Understanding the factors that make these coins so sought after, such as low mintage, high grading, historical context, and collector demand, empowers enthusiasts and investors to make informed decisions.

While owning a multi-million-dollar coin may be out of reach for most, the principles that drive their value apply to all levels of collecting.

Whether you’re just starting or looking to assess a family heirloom, knowledge of grading, provenance, and market trends can make all the difference.

At Coinnotes News, our professionals are committed to helping collectors navigate the exciting and often complex world of numismatics. Rely on us for expert guidance on grading, valuation, and building a portfolio of gold coins worth money.