Expert Tips on Valuing, Grading, and Selling Your Gold Coins for Maximum Profit and Security

Over the past five years, the price of gold has surged more than 50%, reaching some of its highest levels in history.

For collectors and investors holding rare gold coins or valuable gold coins, this market upswing represents a prime opportunity to turn those assets into cash, but doing it right requires more than just walking into the nearest coin shop.

If you’re wondering how to sell gold coins for cash, understanding the process from valuation to transaction is key to maximizing your return and avoiding costly mistakes. The team at Coinnotes News has put together this comprehensive guide to help you navigate every step with confidence.

Here’s what you’ll learn in this article:

- What makes gold coins valuable beyond their gold content, including numismatic factors.

- How coin grading and authentication can significantly impact your sale price.

- The pros and cons of different selling methods, from local dealers to online platforms.

- A step-by-step breakdown of how to prepare, price, and complete a sale.

- Common mistakes sellers make and how to avoid them.

By the end of this guide, you’ll know exactly how to sell gold coins, whether you have bullion or collectible coins, for the best possible price while protecting your assets and avoiding unnecessary risks. Let’s get started.

Understanding What Makes Gold Coins Valuable

Before you can sell your gold coins, it’s essential to understand what gives them value. While the gold content itself plays a major role, many coins also carry numismatic value, which is a premium based on rarity, demand, and historical significance.

For me, learning about numismatic value was a huge learning curve, but trust me; the more you understand about your coins’ true worth, the more prepared you’ll be when you’re ready to sell.

Gold Content and Market Price

Most gold coins are valued in part based on their bullion content. This is measured in troy ounces, with common purities including 22 karat (91.67% pure) and 24 karat (99.99% pure).

The current market price of gold, known as the spot price, is set by global benchmarks like the London Bullion Market Association (LBMA).

- Check live gold prices on trusted financial platforms or bullion dealers.

- Multiply the coin’s gold weight by the current spot price to estimate its melt value.

However, bullion value is just the starting point. Many coins are worth much more due to collectibility.

Rarity and Numismatic Value

Rare gold coins and valuable gold coins often command prices well above their metal content. According to this article from Coinfully about how to sell gold coins, this numismatic value is influenced by factors such as:

- Mint year and location: Older coins or those from limited mints can be prized by collectors.

- Condition: Coins in pristine condition (especially uncirculated) are more desirable.

- Historical significance: Coins tied to key events or eras may fetch a premium.

For example, a common American Eagle may sell near its bullion value, while a rare 1933 Double Eagle could be worth millions due to scarcity and history.

Coin Type and Popular Examples

Some gold coins are more recognizable and in higher demand, which can boost resale value. Popular gold coins include:

- American Gold Eagles: Backed by the U.S. Mint, highly liquid and trusted worldwide.

- Krugerrands: South African coins known for their durability and wide recognition.

- British Sovereigns: Historic coins with strong collector interest.

The more widely recognized your coin is, the easier it will be to sell and the more offers you’re likely to receive.

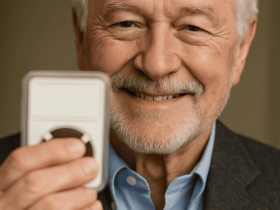

Coin Grading and Authentication

Grading and authenticating your gold coins is one of the most important steps to getting top dollar. A professionally graded coin provides buyers with confidence in its quality and legitimacy.

Professional Grading Services

Trusted grading companies like the Numismatic Guaranty Company (NGC), Professional Coin Grading Service (PCGS), and Certified Acceptance Corporation Grading (CACG) evaluate coins using the Sheldon Scale, which ranges from 1 (poor) to 70 (perfect condition).

Once graded, coins are sealed in tamper-proof holders, often called “slabs,” that include certification details. This encapsulation protects the coin and adds legitimacy.

Benefits of Certification

Certified coins typically sell faster and for higher prices. Buyers are more willing to pay a premium for coins that have been professionally authenticated and graded. Certification can:

- Reduce buyer skepticism and risk.

- Provide a standardized condition rating.

- Protect coins from damage and tampering.

Preliminary Self-Grading

While professional grading is ideal, basic self-assessment can help you gauge value before submitting coins. Look for:

- Surface wear or scratches.

- Shine or luster.

- Sharpness of design details.

Use online comparison tools or coin catalogs to estimate grading, but remember that only certified grades carry weight in the market.

Preparing To Sell Your Gold Coins

The way you prepare your coins can directly impact how much you earn from a sale. Follow these key steps before listing or approaching a buyer.

Document and Organize

Gather all available documentation, including:

- Receipts or proof of purchase.

- Grading reports and certificates.

- Notes on weight, purity, and type for uncertified coins.

Organizing this information helps you present your coins professionally and supports claims of authenticity.

Research Current Prices

Monitor the current gold spot price and trends in the collectible coin market. This helps you pick the right time to sell and set realistic expectations.

- Use resources like Kitco and the LBMA market updates.

- Compare recent sales of similar coins on auction sites or dealer listings.

Store and Handle Properly

Never clean your coins, since doing so can reduce their value dramatically by altering the surface. Instead:

- Use cotton gloves when handling.

- Store in acid-free holders or coin capsules.

- Keep in a dry, secure location.

Where and How To Sell Gold Coins

There are several ways to sell gold coins, each with its own pros and cons. Your choice may depend on your goals, such as speed, convenience, or maximizing profit.

Local Coin Dealers and Shops

These offer quick, face-to-face transactions and immediate cash. However, dealers need to make a profit, so offers may be below market value.

- Pros: Fast, secure, and simple

- Cons: Lower payouts, especially for rare gold coins

Online Buyers and Marketplaces

Platforms like Coinfully and Kitco offer free appraisals, insured shipping, and fast payments. Selling online gives you access to a broader audience.

- Pros: Competitive offers, convenience, reach

- Cons: Must verify buyer reputation, shipping risks

Auctions and Collector Forums

These are ideal for rare or valuable gold coins. Auctions may drive up prices through bidding wars, but they often take time and involve seller fees.

- Pros: Potential for high prices, targeted buyers

- Cons: Commission fees, longer sale process

Precious Metal Buyback Programs

Many mints and bullion dealers offer buyback programs, often paying near spot price for bullion coins.

- Pros: Transparent pricing, reliable

- Cons: Not ideal for coins with numismatic value

Step-by-Step Guide for Selling Valuable Gold Coins

Follow this proven process to sell your gold coins confidently and securely.

Step 1: Identify and Assess

Determine the coin’s type and gold content and whether it’s certified. Use catalogs or online tools if needed.

Step 2: Get Multiple Offers

Always get quotes from several sources. Use online quote forms or visit multiple dealers to compare.

Step 3: Authenticate and Inspect

Buyers may inspect your coin for authenticity. For uncertified coins, consider submitting to NGC or PCGS beforehand.

Step 4: Negotiate Fairly

Use your research to back up your asking price. Be firm but open to reasonable counteroffers.

Step 5: Finalize the Sale

Complete the transaction in writing. Get a receipt, and choose a secure payment method such as bank transfer or certified check.

Step 6: Ship Securely

If selling remotely, use insured, trackable shipping. Package coins carefully and retain proof of delivery.

Factors That Affect How Much You’ll Get

Condition and Grade

Higher graded coins command premium prices. Certified coins are especially attractive to collectors and investors.

Market Timing

Selling when gold prices are high can maximize returns. Monitor spot prices and economic trends regularly.

Rarity and Demand

Rare gold coins or those in high demand can sell for much more than their melt value. Historical coins or limited mintage items often fall into this category.

Dealer Reputation

Well-known, trusted dealers may offer slightly less but provide security and peace of mind. Private sales may yield more, but they carry more risk.

Tax and Legal Considerations

Profits from selling gold coins may be subject to capital gains tax, depending on your country or state. It’s important to:

- Keep detailed records of purchases and sales.

- Consult a tax professional if unsure about reporting requirements.

- Check local laws regarding documentation and ID requirements.

Safety and Fraud Prevention

Protecting yourself is just as important as maximizing profit. Follow these safety tips:

Verify Buyer Credentials

Only work with licensed dealers or platforms with strong reputations. Look for BBB ratings and professional affiliations.

Use Secure Methods

- Always use insured shipping when mailing coins.

- Get written receipts for all transactions.

- Use verified payment methods such as bank transfers or escrow services.

Avoid Common Scams

- Never accept unsolicited offers.

- Decline lowball offers from pawn shops without comparison.

- Always get multiple appraisals before agreeing to a sale.

Final Thoughts on Selling Gold Coins

Successfully selling gold coins requires more than just knowing their melt value. Whether you’re holding rare gold coins with historical significance or valuable gold coins with numismatic appeal, understanding grading, authentication, market trends, and buyer credibility is key to achieving the highest return.

As we’ve outlined, taking the time to organize your documentation, get multiple offers, and select the right selling method can significantly impact your payout.

Certified coins, in particular, tend to attract more competitive bids and faster sales. Remember that timing the market and working with reputable buyers can make all the difference.

If you’ve been wondering, How to sell my gold coins?, don’t rush the process. Instead, prepare strategically and educate yourself using trusted resources. The professionals at Coinnotes News are here to help you every step of the way.