A flurry of negative news in the last couple of days seems to have taken a toll on bitcoin’s price. The cryptocurrency, which almost touched $20,000 in December retreated to below $8,000 earlier this week and even may have room to fall further. At 15:16 UTC, the price of a single bitcoin was $7,538.98, a steep decline of 7.28% from its price 24 hours ago. That price drop wiped off more than $8 billion from its value in a couple of hours. Cryptocurrency markets moved in tandem with bitcoin’s price movements and fell below $300 billion. At 17:37 UTC, they had a total market cap of $282.8 billion.

A variety of reasons are being put forward as possible causes for the fall. A spike in trading volume for bitcoin futures with sell orders is one. A Twitter user PhilCrypto pointed out that volumes for sell orders on bitcoin futures multiplied yesterday. Since their introduction three months ago, bitcoin futures have trailed bitcoin prices because their trading volumes are fairly low and institutional investors have mostly stayed away.

But trading volumes at CME and Cboe, both of which offer bitcoin futures trading, jumped yesterday. For example, volumes for contracts expiring in April multiplied from $2433 to $3704 at CME yesterday. Volumes for the same contract shot up similarly at Cboe. If the attributed reason is true, then it could be the first time that futures have influenced bitcoin prices. The overall value of bitcoin futures traded still remains fairly low as compared to the volumes of trading at spot cryptocurrency exchanges.

Other possible reasons for the fall in prices for bitcoin and other cryptocurrencies are the closure of two Japanese exchanges and a new report claiming that 81% of initial coin offerings (ICOs) are scams. In the former case, Japan-based Mr. Exchange and Tokyo GateWay had filed applications with regulatory authorities to begin offering services to domestic investors. But they withdrew the applications yesterday, according to news reports. Japanese authorities have imposed strict operational requirements for cryptocurrency exchanges after the Coincheck hack earlier this year. Per coinmarketcap.com, Mr. Exchange, which started life as an exchange for trading Ripple’s XRP, had trading volumes of $601,145 as of this writing.

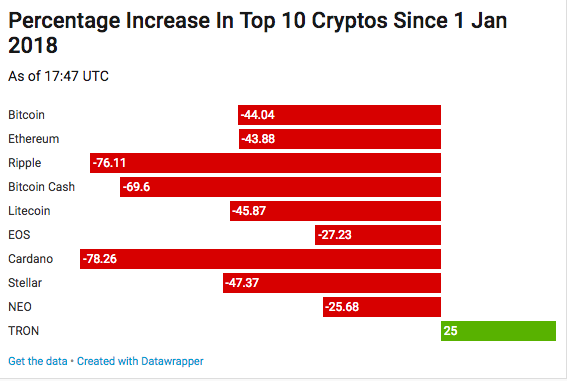

With the exception of Tron and EOS, the top 10 most valuable cryptocurrencies all registered declines. Tron, which is up by 11% from its price 24 hours ago right now, is an ethereum smart contract platform backed by Alibaba founder Jack Ma. Its price shot up two months ago after announcing a partnership with China’s biggest streaming platform. But the coin is yet to be developed. Allegations of snitching code from ethereum and a shoddy whitepaper further harmed its valuation and its market cap crashed from $15 billion to $3 billion within a week. As of this writing, the cryptocurrency had a market cap of $3.2 billion. A possible reason for its resurgence is the impending launch of a platform to test its cryptocurrency.

#TRON Test Net Launch Countdown 2 days, 50 hours, 3,000 minutes, 183,000 seconds! #TRX $TRX

— Justin Sun (@justinsuntron) March 29, 2018

Leave a comment